Coinbase Review 2024: Is It the Best Crypto Exchange?

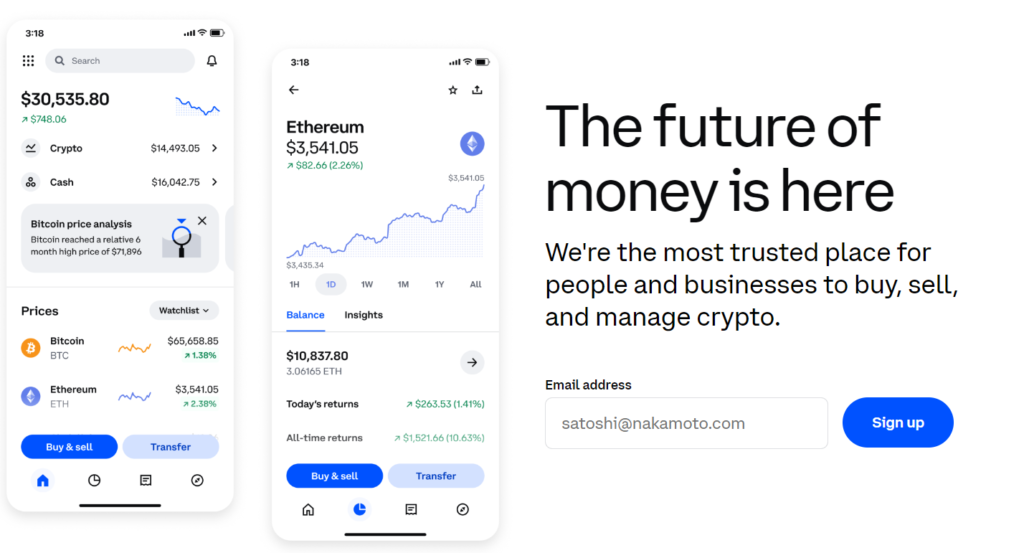

One of the big players in the crypto world is Coinbase. It caters to everyone from beginners to advanced traders and institutions. This makes it a versatile choice for many.

Pros

- A wide-selection of coin offerings

- Convenient user experience

- Several crypto wallet options

Cons

- Expensive and difficult-to-understand fee structure for beginners

- High staking commissions

Who Does Coinbase Serve Best?

Coinbase is highly recommended for both beginner and professional traders. Advanced users may focus energy here to get a good landing place with the platform.

What Makes Coinbase a Good Choice?

With a low threshold account minimum of `2, being able to become a Coinbase user is straightforward and serves well as a starting point for novices.

Coinbase tells crypto traders to get started: Learn more about your investment now with the platform’s “earn while you learn” program. A series of video classes and exams enable beginners to learn even more about different cryptocurrencies and get rewarded.

The crypto is staked online at the exchange, where it usually is self-bonded within a staking model and a holder gets a return.

On the bright side, say what you will, but one of Coinbase’s strongest features remains its live customer support. In addition to an online help center and chat system, Coinbase also offers live phone support, conspicuously absent from so many cryptocurrency exchanges.

To be more specific, users can take several routes with the storage of their secure crypto keys. Indeed, Coinbase offers its customers three wallets for independent use.

The Coinbase Wallet is the platform’s hot wallet product, housing “hundreds of thousands” of crypto assets. The other two are the Coinbase dApp Wallet and storage via the Coinbase Exchange itself: the platform’s “default wallet.”

Coin base’s Disadvantages

The biggest downside is perhaps the relative complexity in the fee structure of the basic version of Coinbase.

They do not obviously disclose their fees because these are essentially “spread fees.” This indicates that they will be calculated upon the filling of your order and may have variables such as location, mode of payment, size of order, and market conditions altogether described.

However, one catch for more sophisticated users is that while Coinbase does offer staking services on its platform, it takes a 25% commission on yields. That places the commission rate on material yields a shade higher than most other top exchanges in the crypto space.

Characteristics of Coinbase

This exchange is undoubtedly one of the stalwarts in the world of cryptocurrency. Following its IPO listing in April 2021, the company has got itself in front of all the stages. Simple to use, yet its fee arrangement is rather esoteric.

Pay

This is what the basic Coinbase platform does with its fees:

it makes you pay, not a maker/taker fee or an overall flat fee but a spread fee, binding down in instantaneous time the price of your transaction. You can’t really see until it’s half-submitted how much exactly you will be forking out in the fee.

Coinbase’s spread fees usually average around 0.5%.

For users of Advanced Trade at Coinbase, the company charges only a much simpler maker/taker fee on all transactions.

Most of the crypto exchanges apply marker/taker fees. A maker supplies liquidity to the platform, and the other way around is a taker. The only problem for the users is that they find out later on, after the deal is accomplished, whether they are the maker or the taker.

As with most other crypto exchanges, Advanced Trade on Coinbase hosts a maker/taker fee schedule that diminishes with the volume of currency the user trades. See the full set of fees on the full set of fees below for Advanced Trade on this exchange.

Internal links

Trading fees on Coinbase

| Pricing Level | Maker Fee | Taker Fee |

| Up to $10,000 | 0.40% | 0.60% |

| $10,000 to $50,000 | 0.25% | 0.40% |

| $50,000 to $100,000 | 0.15% | 0.25% |

| $100,000 to $1,000,000 | 0.10% | 0.20% |

| $1,000,000 to $15,000,000 | 0.08% | 0.18% |

| $15,000,000 to $74,999,999 | 0.06% | 0.16% |

| $75,000,000 to $250,000,000 | 0.03% | 0.12% |

Apart from the cryptocurrency trading fees, on a select few stablecoin pairs, Advanced Trade employs a 0.001% taker fee. Several of these include USD Coin (USDC)/EUR, Tether (USDT)/USD.

Security

Besides, its security measures extend to scanning the dark web for signs that any of its customer passwords might have leaked out, suggesting the use of a third-party security key and pushing in security prompts on-site.

Bank deposits on the Coinbase website, using U.S. dollars deposited, are insured by the FDIC, whereas cryptocurrency is not FDIC insured.

It’s crucial for customers to follow Coinbase’s strict security tips. This helps keep their accounts safe.

From March to May 2021, Coinbase faced a series of hacks.

These hacks affected over 6,000 customers, draining their accounts.

Creating a Coinbase Account

You only need to be 18 or older, have a government-issued ID, internet, and at least a phone number to create an account. It does not differ from most cryptocurrency exchanges in having no fees for account creation.

When a user clicks the “get started” button from the Coinbase homepage, he or she will be asked for his or her legal name, email, and password. They also need to provide proof of location.

A verification email will be sent to the user.

Once the user verifies their email, they also have to verify their phone number for two-factor authentication.

Lastly, the questions after opening an account with this exchange require one to fill in only a little information on employment and source of funds in addition to a photograph of the ID. Afterward, users can link up to a payment method and, from here, proceed to fund the account.

Cryptocurrency wallets

Since there are many and varied types of crypto wallets, for the same reason, This exchange provides more than a one-size fits-all wallet meant for your storage needs in the world of crypto. Actually, the exchange provides three different types of hot/online wallets:

Coinbase Wallet: This wallet supports “hundreds of thousands” of crypto assets. It’s a standalone app that doesn’t need a Coinbase account.

You can also store Non-Fungible Tokens (NFTs) here.

Coinbase Exchange: Choosing this option means your trades will be on Coinbase. But, your private keys are stored with the exchange, making them vulnerable to hacking.

Coinbase dApp Wallet: This is where your ERC-20 tokens on the Ethereum network are kept.

Coins at the Coinbase platform

There are more than 200 cryptos and stablecoins listed on this exchange for trading. Some of the most popular cryptos listed on Coinbase include:

| Coin | Available on Coinbase |

| Bitcoin (BTC) | X |

| Ethereum (ETH) | ✔ |

| XRP (XRP) | X |

| Cardano (ADA) | ✔ |

| Solana (SOL) | ✔ |

| Dogecoin (DOGE) | ✔ |

| Polkadot (DOT) | ✔ |

| Polygon (MATIC) | ✔ |

| TRON (TRX) | X |

A full list of coin offerings this exchange can be found here.

Customer Ratings

| Gemini At A Glance | |

|---|---|

| Trading | |

| Advanced Trading Features | |

| Security & Storage | |

| Crypto Wallet | ✔ |

| Staking | ✔ |

| Lending | X |

| Margin Trading | X |

How Coinbase could improve

Make Fee Policy Simple

For a simplified structure, the basic platform of this exchange still remains very cumbersome. Extra fees depend on the trader’s location, payment method, order size, and market conditions.

Thus, users on this bare-bones platform might find it tough figuring how much they might pay before every trade.

Novice users would particularly be benefited, something as straightforward as the Advanced Trade platform for all their trades.

Delegate to professional node

It’s worth mentioning that you can easily stake cryptocurrency on this exchange; however, the downside is that, of course, when customers stake it on Coinbase, the coin loses 25% of yield since that fee needs to be sent back to the exchange. It’s a heavy price.

Methodology

Our cryptocurrency exchange rankings were based on an in-depth review of features and options at nearly 25 exchanges, trading apps, and brokerage platforms with cryptocurrency trading options.

In deciding the overall better exchanges for new users within the 2020 cryptoverse, we took a balanced view across all of these 25 attributes and offerings. The editorial team developed a normalized methodology that sizes the 10 most common benchmark features and variables of quality across the platforms.

Other Base Trading Features Combines basic trade features into one factor under overall and novice rankings. Other Features Other ranking factors include the availability of services and integration of user-friendly services, customer service, educational resources, custody and firm undertakings, staking, and other features, in some instances.

Every rank was calculated by the summation of the weight values through all or part of the essential factors for their total. At the same time, the best crypto exchanges for beginners ranking did not consider Margin trading, Platform lending, and Advanced Trading.

Coinbase FAQs

What is Advanced Trade?

this exchange has just launched a newer iteration of its Pro platform called base Advanced Trade, which has shifted all Pro features from the website and embedded in some new ones as well into the basic site, in addition to renaming this even more enhanced version of its service as Advanced Trade.

What can people earn as rewards on Coinbase?

provides its few rewards programs. You can earn returns on this exchange through staking your crypto for up to 5.75%. The exchange also offers the “earn while you learn” program.

Does Coinbase offer a rewards or cashback card?

it has a rewards debit card, the Coinbase Card. The Coinbase Card is a Visa debit card. It gives rewards in cryptocurrencies for certain purchases. Besides, there are no spending fees or annual fees.

Are NFTs tradeable on Coinbase?

This is the ultimate NFT platform, Use this exchange to follow top collections and creators. All NFTs on this exchange can be bought with US dollars or Ethereum.

How Can One Trade Derivatives on Coinbase?

This exchange allows for trading in derivatives.

In so far as derivatives go, This exchange deals majorly in futures. Futures trading on the platform is allowed primarily in five asset classes: Ethereum, Bitcoin, Bloomberg U.S. Large Cap Index, crude oil and SuperTech, an index of 15 U.S. tech giants.