Kovo Credit Builder Review 2024: The Best Tool for Building Credit

Building credit is an essential part of personal financial growth. A strong credit score opens doors to better interest rates on loans, easier approval for rental applications, and even more affordable insurance premiums. For individuals with little or no credit history—or those seeking to rebuild their scores—finding a reliable credit-building tool can make all the difference.

Enter Kovo Credit Builder, a new and notable tool in 2024 designed to help individuals improve their credit profiles. With a simple, straightforward approach and accessible features, Kovo has quickly gained attention as a viable solution for credit-building. But the question remains: Is Kovo the best tool for building credit in 2024?

Overview of Kovo Credit Builder

Kovo Credit Builder is a service specifically designed to assist users in building their credit scores through a low-risk, installment-based plan. One of the standout aspects of Kovo is its no credit check policy, making it accessible even for those with poor or limited credit histories. Users can expect instant approval, allowing them to start building credit immediately after signing up.

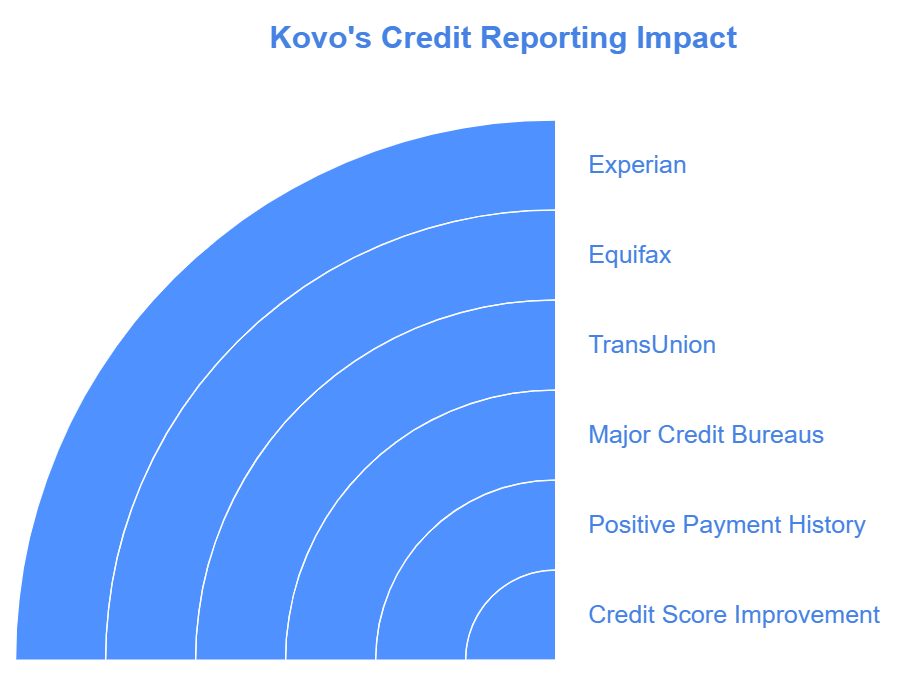

For a flat fee of $10 per month over a period of 24 months, reports users’ payment history to all major credit bureaus—including TransUnion, Equifax, Experian, and Innovis. This consistent reporting helps users establish positive credit behavior, contributing to the overall improvement of their credit scores without the burden of high interest or hidden fees.

How Kovo Credit Builder Works

This Credit Builder offers a simple and straightforward process for users looking to improve their credit scores. Here’s how it works step by step:

Application Process

The first step is creating a free Kovo account, which is quick and hassle-free. Users only need to provide basic personal information, and the best part is that no credit check is required. Once the sign-up is complete, users receive instant approval, allowing them to begin building credit immediately.

Payment Plan

The site operates on a clear and affordable payment plan. Users pay a flat fee of $10 per month for a period of 24 months. There are no hidden fees, interest, or additional charges, which makes the process predictable and budget-friendly.

Credit Reporting

One of the key benefits of Kovo is its commitment to helping users build credit by reporting their payment activity to the major credit bureaus. Each month, kovo reports payments to TransUnion, Equifax, Experian, and Innovis, ensuring that users’ positive payment history contributes to their credit score improvements.

Educational Component

In addition to helping users build credit, Kovo provides an optional educational component. Users have access to financial literacy courses designed to help improve their money management skills. While these courses are not mandatory, they offer valuable insights for users looking to better understand personal finance and strengthen their overall financial health.

User Experiences and Success Stories

Real-life feedback from Kovo users provides valuable insights into the effectiveness of the service. Many users have reported significant credit score improvements shortly after beginning the program. Some users saw increases of 34 to over 100 points within just a few months, demonstrating the impact of Kovo’s consistent credit reporting.

Beyond score improvements, users also praise Kovo’s customer support, especially in cases where missed payments occur. Kovo’s team is known for its understanding and flexibility, helping users stay on track without punitive measures.

Another major highlight from user experiences is the straightforward nature of Kovo’s terms. Customers appreciate the absence of hidden fees and complicated fine print, a feature that stands out compared to other credit-building tools. This transparency has made Kovo a preferred option for individuals seeking a simple, reliable way to build their credit.

RELATED ARTICLE

Pros and Cons of Kovo Credit Builder

Like any financial tool, This Credit Builder has its strengths and weaknesses. Below is a breakdown of its pros and cons:

Pros

- No credit check required

- Low, flat monthly fee with no interest

- Reports to all major credit bureaus

- Positive feedback on customer service

Cons

- Limited loan amount ($240)

- Revolving credit can only be used within Kovo

- Building credit takes time, not a quick fix

- Limited educational resources may not appeal to all users

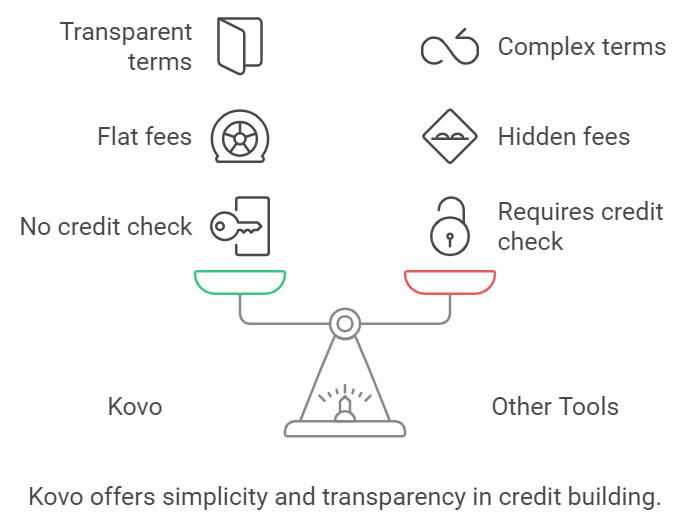

How Does Kovo Compare to Other Credit-Building Tools?

When compared to other credit-building tools, Kovo stands out for its simplicity and accessibility. Many other services in the market require credit checks, involve complex terms, or charge higher fees. Kovo, on the other hand, offers a straightforward plan with no credit check, flat fees, and easy-to-understand terms.

While some alternatives may provide larger loan amounts or more comprehensive financial education, they often come with additional interest rates, hidden fees, or complicated application processes. Kovo’s transparent pricing and focus on core credit-building essentials make it an attractive choice for those looking to boost their credit score without the hassle of navigating complex financial products.

Who is Kovo Credit Builder Best Suited For?

Kovo Credit Builder is ideally suited for individuals who:

- Have limited or poor credit history and are looking for a simple way to improve their credit scores without needing to meet strict financial requirements like a credit check.

- Want a no-hassle, straightforward tool to help them build credit over time, with a predictable monthly payment and no additional fees or interest.

It’s perfect for those who prefer an easy and affordable solution to credit building, especially for beginners who want to establish a positive credit record.

However, Kovo may not be the best fit for individuals seeking:

- Higher loan amounts: Since Kovo offers a modest loan of $240, those in need of a more substantial loan might want to explore other options.

- Faster results: Building credit takes time, and Kovo is not designed as a quick fix for urgent credit score improvements. People looking for more immediate results may need to look into other credit-building tools.

Conclusion: Is Kovo Credit Builder the Best Tool for 2024?

In conclusion, Kovo Credit Builder has several key strengths that make it an attractive choice for 2024. With an easy application process, affordable monthly payments, and effective credit reporting to all major bureaus, Kovo provides a reliable way to steadily build credit without the complexities often associated with other credit-building services.

While Kovo may not offer large loans or rapid results, its focus on simplicity, transparency, and user experience positions it as one of the top options for individuals seeking to improve their credit in a manageable way.

Ultimately, whether Kovo is the best tool for building credit in 2024 depends on your specific needs. For those looking for a stress-free, gradual approach, Kovo is an excellent option. If you need larger financial support or quicker credit score gains, you may want to consider other alternatives.

For more details or to see if Kovo is the right fit for you, explore their offerings further, or evaluate other tools to suit your personal credit-building goals.

FAQ

1. How long does it take to see credit score improvements with Kovo Credit Builder?

Most users report seeing credit score improvements within a few months, typically ranging from 34 to over 100 points, depending on their credit profile and payment history.

2. Does Kovo Credit Builder require a credit check to sign up?

No, Kovo Credit Builder does not require a credit check. This makes it accessible for individuals with limited or poor credit history.

3. How much does Kovo Credit Builder cost?

Kovo charges a flat fee of $10 per month for a duration of 24 months, with no interest or hidden fees. This payment helps establish a positive credit history as it’s reported to the major credit bureaus.

4. Which credit bureaus does Kovo report to?

Kovo reports your monthly payments to TransUnion, Equifax, Experian, and Innovis, ensuring that your credit-building efforts are recognized by all major bureaus.

5. Can I use Kovo Credit Builder if I miss a payment?

Kovo offers flexible customer support in case of missed payments. It’s recommended to contact their support team as soon as possible to make arrangements and avoid negative impacts on your credit score.